We develop comprehensive plans that incorporate the legal, financial, and health care needs of our clients.

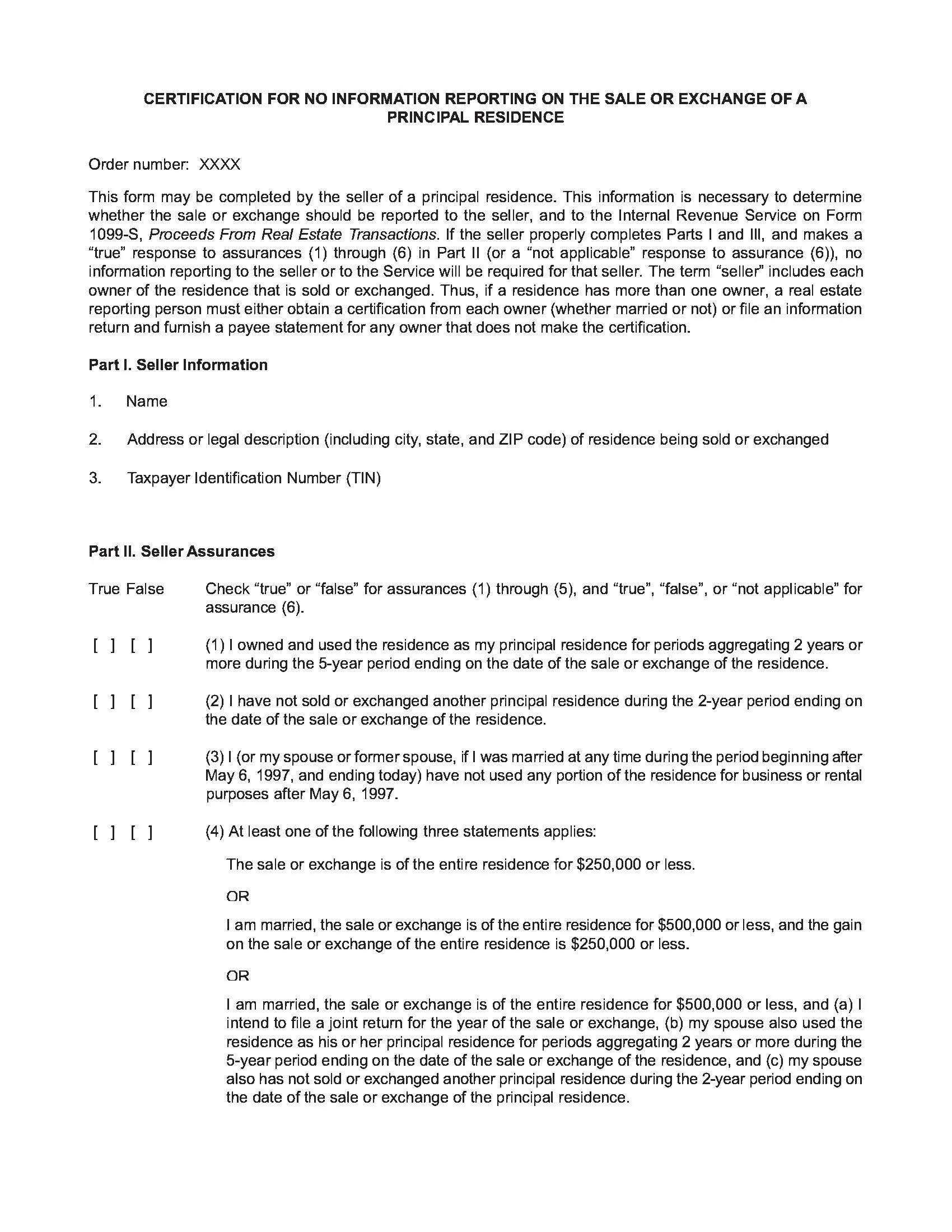

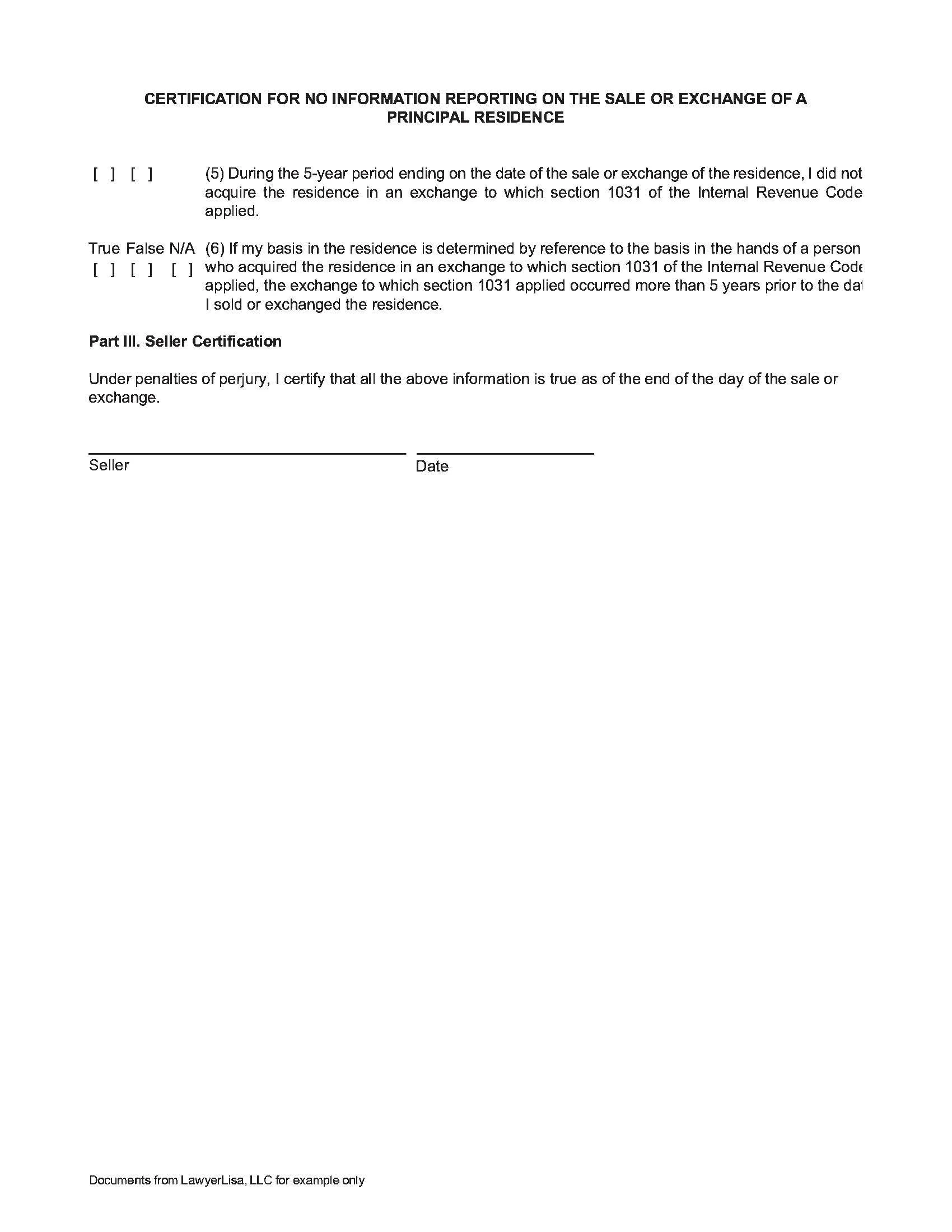

Principal Residence Gain Exclusion

Sellers will be issued a 1099-S at closing. This form is reported to the IRS. Sellers should consult their tax advisor to determine the tax consequences of the sale of their property. The 1099-S given at closing/emailed right after closing is the only copy of the form that may be provided. A duplicate may be requested from the closing office.

The IRS has an exception to the 1099 rule for qualified owners who used the property as their primary residence.

Here are the basic requirements:

Section 121(a) generally provides, with certain limitations and exceptions, that gross income does not include gain from the sale or exchange of property if, during the 5-year period ending on the date of the sale or exchange, the taxpayer has owned and used the property as the taxpayer’s principal residence for periods aggregating 2 years or more.

Section 121(d)(6) provides that the exclusion from income under § 121(a) does not apply to that part of the gain from the sale of any property that does not exceed the depreciation adjustments (as defined in § 1250(b)(3)) attributable to the property for periods after May 6, 1997.

Section 1.121-1(e)(1) provides that § 121 does not apply to the gain allocable to any portion of the property (separate from the dwelling unit) sold or exchanged for which a taxpayer does not satisfy the use requirement. Thus, if a portion of the property was used for residential purposes and a portion of the property (separate from the dwelling unit) was used for nonresidential purposes, only the gain for the residential portion is excludable under § 121.

Answers to some common questions:

The tax code recognizes the importance of home ownership by allowing you to exclude gain when you sell your main home. To qualify for the maximum exclusion of gain ($250,000 or $500,000 if married filing jointly), you must meet the Eligibility Test.

If you used 1031 Like Kind Exchange money to purchase the home in the last 5 years, you cannot use this exclusion.

If you became physically or mentally unable to care for yourself, and you used the residence as your principal residence for 12 months in the 5 years preceding the sale or exchange, any time you spent living in a care facility (such as a nursing home) counts toward your 2-year residence requirement, so long as the facility has a license from a state or other political entity to care for people with your condition.

You may take the exclusion only once during a 2-year period.

If you or your spouse are a member of the Uniformed Services or the Foreign Service, an employee of the intelligence community of the United States, or an employee, enrolled volunteer or volunteer leader of the Peace Corps, you may choose to suspend the 5-year test period for ownership and residence when you’re on qualified official extended duty. This means you may be able to meet the 2-year residence test even if, because of your service, you didn’t actually live in your home for at least the 2 years during the 5-year period ending on the date of sale.

If you don't meet the Eligibility Test, you may still qualify for a partial exclusion of gain. You can meet the requirements for a partial exclusion if the main reason for your home sale was a change in workplace location, a health issue, or an unforeseeable event. Consult your tax advisor.

Still need more information? Check out this IRS publication and contact your tax professional.

*Answers obtained from IRS Publication 523 (updated 8/4/2022)